USDA Framework Money to possess Building an alternative Home

An effective USDA design mortgage is a type of home loan given courtesy the usa Agency from Farming (USDA). Such fund are designed to help anyone inside the outlying areas loans the construction from an alternative house with USDA-recognized financial support from Single Household members House Guaranteed Loan Program.

Whether you’re just starting to talk about the choices otherwise you are able to diving on the app processes, this guide is designed to give you a clear understanding of how USDA framework financing functions and how you could potentially influence them to create your perfect the place to find lives. We’ll walk you through just what USDA structure financing try, along with trick has actually, standards, and benefits and drawbacks; up coming, assist you brand new steps in order to safer a good USDA framework financing to help you build your fantasy domestic.

Single-Intimate Funds

Perhaps one of the most much easier options that come with USDA structure money are that they’re single- otherwise one-time-romantic money. Consequently the loan process is actually basic into one software and something closing procedure for both the framework phase together with finally home loan.

For most other loan applications, strengthening an alternative household means a couple of fund: you to to the design phase and something on home loan once the home is created. All these loans must glance at the closure procedure individually.

Yet not, having an effective USDA single-romantic design mortgage, individuals only need to look at the closure processes shortly after. That it not simply conserves some time and minimizes documentation and decreases settlement costs.

Construction-to-Long lasting Finance

Getting low-USDA construction fund, the newest transition about first construction financing to help you a long-term financial is going to be state-of-the-art and you will expensive. Yet not, USDA single-intimate structure funds are created to efficiently changeover about structure stage on the long lasting financial without the need for additional funds or refinancing.

loans with no credit check Midway

USDA structure-to-permanent fund blend a construction financing that have a timeless USDA financing in one financial. Once your new home is performed, the construction financing have a tendency to instantly changeover so you can a classic 29-season repaired-rate USDA home loan.

Build Loan and no Money Down

Probably one of the most remarkable features of USDA structure finance was the capacity to money your new family build and no off percentage. This will be a rare brighten versus almost every other structure loans given that old-fashioned lenders commonly require a serious down-payment for a bigger upfront rates.

USDA Framework Loan Criteria

Just like any USDA loan, the latest homebuyer have to see income and qualifications standards, plus the property must be in a great USDA-recognized location. Yet not, certain most fine print can be found, including:

- Our home fits most recent IECC, or further password, for thermal conditions.

- The new homebuyer have to receive a separate framework warranty about builder.

- Any too-much funds from the construction need certainly to wade directly for the the brand new mortgage idea.

- Loans ily household, were created house, otherwise qualified condominium.

USDA Recognized Builders

The newest USDA makes it necessary that the lender accept any developers otherwise builders you want to explore. On the company or creator to be eligible to make your home by using the USDA mortgage, they have to:

- Provides no less than 2 yrs of expertise building solitary-relatives home

- Furnish a housing otherwise contractor licenses

The way to get an effective USDA Build Financing to own Home-building

If you’re considering an excellent USDA solitary-close construction loan, here you will find the steps you will want to go after to improve your chances of acceptance and make certain a soft experience.

1. Search Lenders Who Render USDA Build Financing

The initial step is to find a lender that provides USDA structure fund. Because these finance was less frequent, researching lenders may require a little extra effort.

Start by calling financial institutions and borrowing from the bank unions near you, since they are likely to be aware of what’s needed of regional communitypare the support, rates, and you will charges of several loan providers offering USDA design money so you can find the best match for your finances.

dos. Find a USDA-Recognized Specialist

After you’ve a loan provider in your mind, the next thing is to determine a builder otherwise builder which is eligible because of the USDA. That is very important, once the a prescription contractor try that loan requirements.

The lender may possibly provide a summary of accepted designers, you can also contact the latest USDA actually having pointers. Make sure that your chose specialist has experience within the finishing tactics you to definitely meet USDA standards and you will legislation.

3. Come across End in an effective USDA-Eligible City

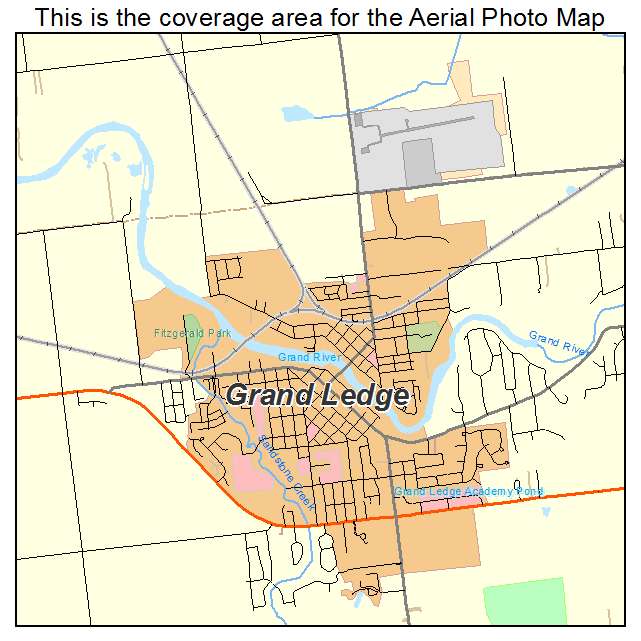

Before you just do it, you need to secure a parcel of land inside the a location that is entitled to USDA capital. USDA money developed to market development in outlying elements, and so the home have to satisfy specific venue standards to help you qualify for a beneficial USDA construction mortgage.

No Comments