Buying a property into the Foreclosures What type of Mortgage Can i Fool around with?

Purchasing property inside property foreclosure isn’t as as simple they was once particularly in finest portion since you might possibly be competing with a residential property whales just who buy homes, remodel, and flip all of them during the a massive funds. Either these a home moguls may even bid to have qualities to help you generate an enormous portfolio out-of property in the anticipation away from a growth particularly in growing places such as Austin Colorado, Miami Florida, otherwise Atlanta, GA among others.

Hence, if you aren’t capable afford cash deals, you must search a page of provide for various style of money so that your quote bring is given serious attention. This can let you go into a legally binding contract obviously which have an escape condition to absorb you from any responsibility if your mortgage is denied will ultimately after on account of an unexpected circumstance. However, which situation is extremely unlikely for many who deal with reputable enterprises.

step 1. Loans

Foreclosed belongings are sold less than market cost whenever you earn accepted for a loan for choosing a home inside the property foreclosure, you really need to do it now. With a somewhat quicker months such 84 days, you could potentially in the near future pay back the mortgage and get a unique property owner.

If you have a credit history in excess of 820, you can get an aggressive annual percentage rate particularly when their long- and you may typical-name candidates was positive instance a reliable occupation inelastic to financial shocks eg a national personnel. After that, monetary risk government steps such insurance, medical cover, or other critical indemnity insurances for notice and you may dependents will get reflect better on your own creditworthiness profile.

After you illustrate that you meet every conditions, the financial institution can offer to provide financing because property name is moved to you. The main benefit of a bank loan is you don’t require the high quality aside-of-wallet 20% downpayment and the currency would be wired for your requirements within 24 hours after acceptance.

dos. FHA 203k rehab Financing

If you are such a situation, this new FHA 203k rehabilitation loan is advisable when you find yourself to find a home during the foreclosures in which solutions are essential before you can flow within the. These financing are backed by the fresh Federal Housing Government (FHA) hence ensures loan originators to guard them from the risks of financing getting low-profit-determined social programmes. Some of the biggest banking institutions providing which loan try Bank out-of The usa and you will Wells Fargo.

- Fix costs are capped at $35,000.

- There’s a down payment from step three.5% of the overall loan really worth (Foreclosures provide + Resolve will cost you).

- The latest problems must not be less than specific pre-computed tolerance to have livability and shelter.

- The latest repair prices have to be expertly appraised and you can fixed therefore pay the will cost you with your own money.

- Do-it-yourself programs commonly permitted.

Nevertheless, the fresh new terminology is actually finest just as in a credit history regarding as the low as 580 or 640 for almost all financial institutions you can be considered into mortgage within lowest-interest levels because this is a government-recognized social enterprise. A choice of a keen FHA 203k treatment mortgage refinancing is even up for grabs for those who ordered an effective foreclosed assets simply to find repair can cost you run-up so you’re able to thousands of dollars one to you simply can’t afford.

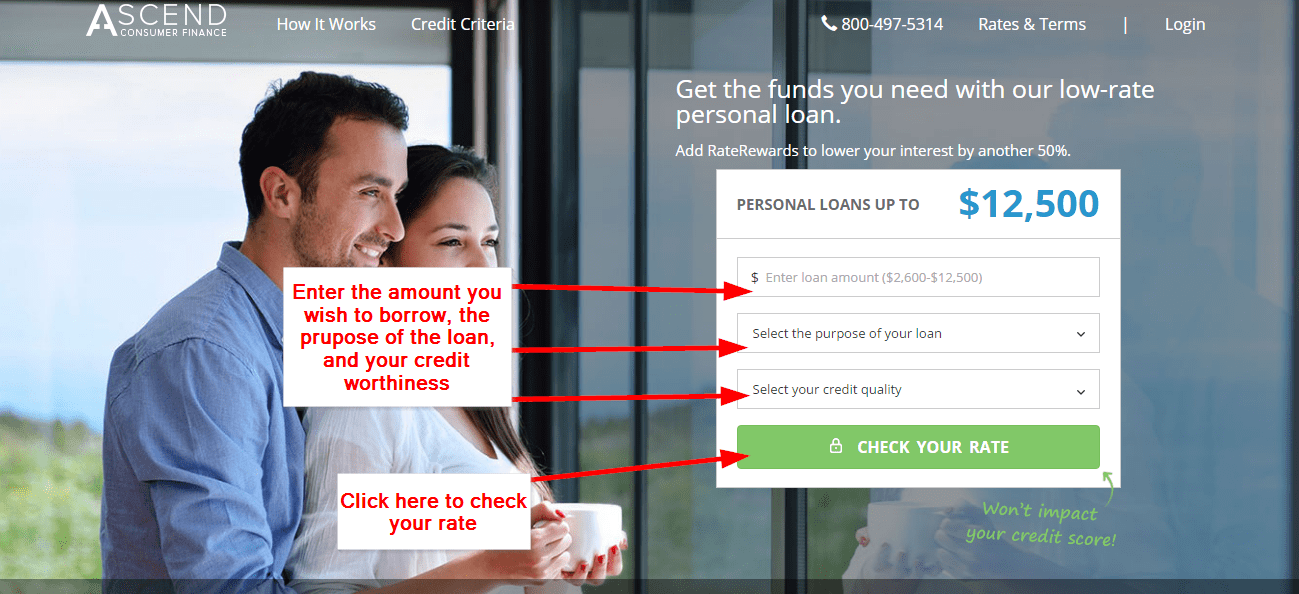

step 3. Financial app

The original stage occurs when you earn pre-recognized having a mortgage. For many financial originators, you must have a credit history with a minimum of 720, additionally the highest rating the higher. As well, you should be prepared to spend the money for 20% mortgage advance payment. not, if you slide additional this type of standards, you ought to request your home loan originator to offer you a Fannie Mae otherwise Freddie Mac-recognized financial.

Fannie mae means Federal national mortgage association while Freddie Mac computer represents Government Mortgage Financial Organization. Talking about Government Sponsored Organizations (GSEs) you to pick mortgage loans out-of banking companies and you can credit unions to allow all of them to succeed alot more mortgages to a lot of borrowers having or even started excluded. With significant link many each other establishments which have comparable expectations away from delivering balances and you may affordability on the mortgage field, Fannie mae was designed to serve founded larger loan providers if you’re Freddie Mac computer mainly provides short mortgage originators.

- Downpayment as little as step 3%

- Cost period of around 3 decades

- A maximum debt-to-money ratio regarding 45%

- A credit history off 620 660

First off, you could nevertheless get a home loan no currency down payment as step 3% demands are going to be repackaged just like the a present for you. At exactly the same time, Federal national mortgage association offers a good HomeStyle system which is modeled like the FHA 230K rehab loan if you buy a foreclosure domestic for the need of repairs subject to small print.

cuatro. Collateral loans

When you have a house currently as well as your property guarantee try higher, you could weighing your options and you can consider house equity financing where the security is employed to help you keep the credit that you are delivering. When you yourself have large equity, your credit score need to be respectively expert in order to thus give you ideal conditions and terms.

An alternate guarantee mortgage is actually refinancing a mortgage. Although not, just be aware that a re-finance can get fail to produce a real income-aside professionals when the settlement costs additionally the interest levels elongate the new break-actually period.

No Comments