Benefits and drawbacks off Domestic Collateral Fund

House Security Loan Certification Conditions

Household equity finance promote home owners the chance to tap into the new security they have produced in their residence, at some point so that you can indeed play with their financing. This type of fund offer financial flexibility, if having renovations, combining financial obligation, otherwise financing existence incidents. But not, as with any loan applications, consumers need certainly to meet specific standards to safer these money.

- Enough family collateral: Never assume all security is actually tappable collateral. Very lenders need you to preserve at least ten-20% collateral in the home following the mortgage, that provides a cushion however if home prices disappear. Quite simply, because of this you can’t acquire a complete amount of equity gathered. Instead, you can merely obtain to 80-90% from it.

- Credit rating: Your creditworthiness performs a giant https://paydayloancolorado.net/marvel/ character when you look at the choosing your loan words and you can interest. A good credit score, normally up to 680 or significantly more than, reveals a reputation in control credit management and you may prompt repayments, offering loan providers more count on on your own power to repay the borrowed funds. Griffin Capital need a credit rating as low as 660, however, remember that increased credit rating tend to lead to better costs and you may terms and conditions.

- Debt-to-earnings (DTI) ratio: This new DTI ratio is a metric loan providers used to view whether or not you really can afford a different financing. It methods the month-to-month loans repayments facing your own disgusting monthly earnings. Loan providers generally speaking pick an effective DTI below 43%, because it indicates a far greater balance ranging from money and you can financial obligation. However, Griffin Investment will accept a good DTI all the way to fifty%.

- Loan-to-really worth (LTV) ratio: LTV is related to the newest security you have of your home in fact it is calculated from the splitting extent your debt on the home loan by the property’s appraised really worth. For example, for folks who are obligated to pay $150,000 and your residence is appraised within $200,000, the newest LTV are 75%. Lenders enjoys a favorite LTV tolerance and you will typically like an LTV regarding 80% otherwise all the way down.

- Secure work and you may earnings: Consistent income assurances you might meet with the month-to-month cost loans of a home collateral loan. Lenders have a tendency to usually consult spend stubs, W-2s, and you can taxation statements to ensure the work status and you can money profile. People who find themselves mind-working or keeps varying income you will face significantly more analysis and want to include more documentation. not, capable also make an application for a no doc household security financing which allows these to qualify using solution records. For-instance, they may play with a lender statement family guarantee loan which allows them to qualify using 12 or 24 months’ property value bank comments unlike shell out stubs otherwise W-2s.

- Possessions form of and you can reputation: The kind of property and its position may dictate good lender’s choice. An initial household possess some other security conditions as compared to good rental property otherwise trips family, according to the financial. At exactly the same time, loan providers should guarantee their resource is sound. Homes that want tall fixes otherwise can be found in portion likely to natural disasters have stricter loan terminology or perhaps ineligible for specific HELOANs.

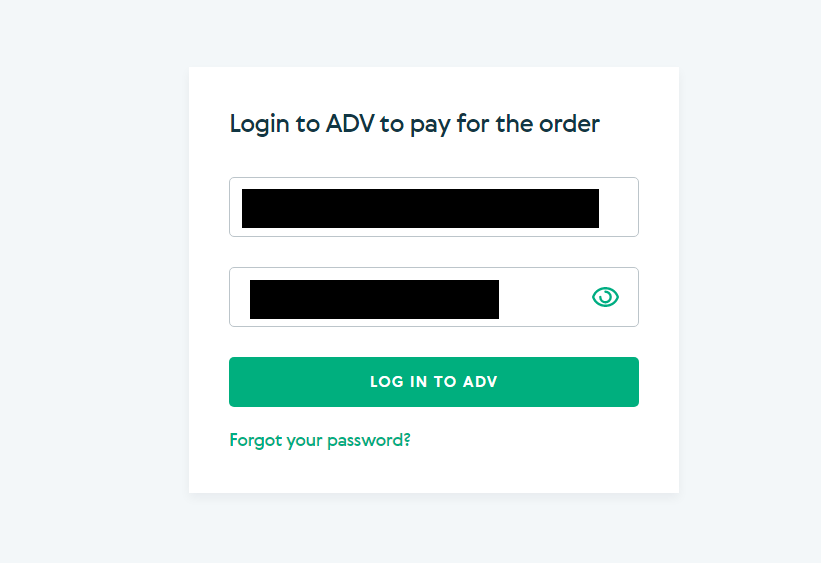

Install the latest Griffin Gold application now!

House collateral fund can be an approach to of a lot economic means, of high costs particularly education to debt consolidating. However, as with any financial devices, HELOANs incorporate their own number of advantages and disadvantages.

Benefits associated with home equity financing

The greatest benefit of property collateral mortgage is that permits you to influence the newest guarantee you’ve built in their home if you are paying down the prominent balance. Most other great things about this type of fund range from the following the:

- Fixed rates: Among the first benefits of family collateral funds is the fact many incorporate fixed interest rates. Instead of adjustable interest levels that are determined by field movement and you can can lead to unstable monthly installments, fixed interest levels continue to be unchanged across the loan’s name. It predictability could possibly offer balances and you may transparency. Knowing the appropriate matter you can shell out monthly can also be improve budgeting and you may financial considered, deleting this new pitfalls out of prospective rates hikes.

No Comments