Discover lenders that may get this to fantasy be realized

What is actually a home Design Mortgage

Lenders is enough time-identity secured finance for buying a home, plot, otherwise homes, and/or building a house towards a block of land. You can use money out of people home loan while the an excellent structure mortgage.

Just like the household build funds try secured personal loans, you should buy them quickly even with down credit scores. Let us evaluate particular biggest banks’ design financing desire costs.

Major Banks’ Construction Loan Rates

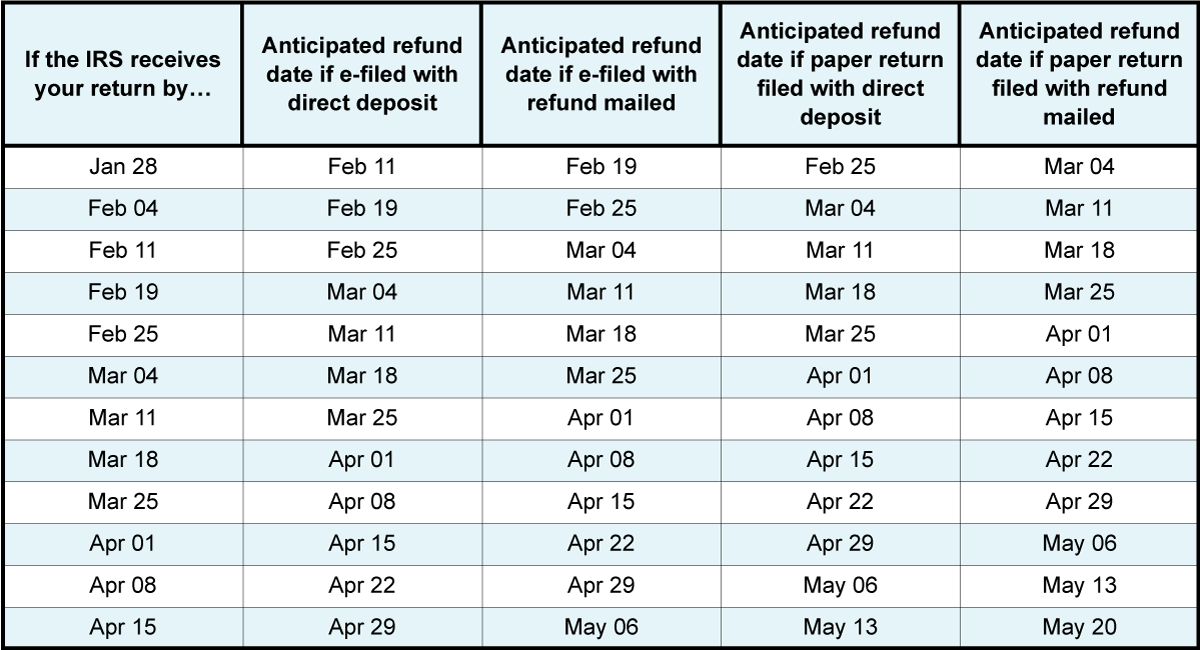

The mortgage count and interest levels can vary depending on the requirements of one’s borrower. You might know more about design home loan rates of interest out of some banks.

On the adopting the desk, https://paydayloanalabama.com/ rates of interest and you may control fees of some major finance companies is actually said. Take note these cost was subject to change from the bank’s discernment. The prices down the page try commonplace as of 2023.

House Build Mortgage Qualification and you will Records

The home construction loan qualification requirements you are going to will vary some based the mortgage vendor. As a whole, you ought to meet up with the after the requirements getting qualified to receive an excellent family build loan –

- Many years should be between 21 and you can 65

- You’ll want a stable revenue stream

- You must have a good credit rating

Having your documents manageable can help a great deal the entire process of a good mortgage smoother. This is exactly an in depth selection of records you’ll need for a home framework financing. A portion of the documents necessary are listed below –

- Duly occupied and signed application for the loan mode

- Title evidence

- Home research

- Passport proportions images

- Money files/report

- Documents regarding the real estate or assets

Unsecured loans out-of moneyview due to the fact a property Mortgage

Possibly bringing a home loan regarding a lender you are going to perspective good situation. In such instances, you could choose immediate unsecured loans from moneyview to pay for your house structure. There are many different advantages of bringing a personal loan away from moneyview –

Completion

If you’re looking for a loan to build your house, a home construction loan is the better choice for you. Funds from a property structure mortgage are often used to pick a story including remodel an existing domestic.

The us government out of Asia has some systems for giving subsidized house money, and you can household design fund supply tax advantages. Domestic construction financing try secured personal loans while having much time tenures, leading them to best for huge paying for assets.

So you can get all the way down interest rates, you can check with assorted banking institutions ahead of zeroing for the using one lender. Figuring your EMI ahead will also help you plan your money during the improve, hence making it simpler so you’re able to cruise through this huge resource.

Home Construction Financing – Relevant Frequently asked questions

Once you’ve decided that you should get a house framework loan, you should see some banking institutions to check on their terms and conditions. SBI, Central Bank out-of Asia, HDFC Bank, etcetera. are typical an effective choices for your, however, which bank is the best for you hinges on your unique instance.

You simply can’t rating 100% of the property price given that home financing regarding the financial, really banking companies often finance just 80% of the house rates. Organizing to possess a more impressive advance payment ahead of time is even a great way to attenuate the duty out-of a massive loan.

Yes, you can purchase income tax positives into the notice element of house build funds around Part 24. Private assets, you could potentially allege up to Rs.2 Lakh for individuals who finish the build contained in this five years out-of brand new sanction of the loan.

Sure, funds from home financing can be used to pick an effective spot also to create property with it.

Mortgage brokers is guarantee-totally free and you will feature a great amount of positives including long tenures, affordable rates, taxation positives, etcetera.

No Comments