Great things about To invest in Foreclosed Residential property And no Money Off

When you are a genuine home individual, to get property foreclosure is actually a different solution to add into your business bundle. Such house is sometimes obtained for less than its industry value. Foreclosed belongings are features caught by banking institutions and you will financial institutions due on the homeowner’s failure to spend its financial. As they might be lesser, also, it is good for can pick foreclosed land that have no cash.

You might be questioning, How do i buy a beneficial foreclosed house without cash? and rightfully thus, due to the fact ordinary design audio near impossible. Yet not, for folks who comprehend the field, to purchase a house inside foreclosure instead of masses away from seed products resource try a possible goal.

I composed this information to handle how you’ll its to find an effective foreclosed home with no money down, providing the expertise and techniques needed to exercise. With the procedures and info defined here, you might enter the market as a separate beginner, strengthening a portfolio without having to make a giant very first capital.

To buy a beneficial foreclosed house in the place of and come up with down costs includes a great great number of advantages, which you could power to fully alter the fresh new landscape of the individual and you may company profit.

Cost-Overall performance

Foreclosures generally sell for below the real market value. A zero-money-down strategy setting you may be including not receiving to your mass degrees of financial obligation, lowering your complete resource.

Money Solutions

By saving money towards very first investment, you might reinvest told you cash back towards property to improve its worth. Whether your carry out renovations, solutions, otherwise improvements, this strategy can help you in gaining a much bigger go back towards the funding when it comes time to offer otherwise book brand new property.

Strengthening Credit

Investing in house is usually a good treatment for create your credit score, if you do the procedure safely. By simply making typical home loan repayments, loan providers see that you may be a reliable borrowing from the bank team. Doing so without getting hardly any money down initial has the benefit of a clear punctual song to good credit.

Control Choices

Whether or not you’re not trying to end up being a full-day buyer and are usually checking for a destination to alive, to buy as opposed to placing money down will give you a clear pathway to help you control. In the current field, looking for property to call their is starting to become all the more hard, but when you helps make this technique functions, it’s a tangible possibility.

Along with these positives, even though, you need to understand that investing a property always arrives with huge risks. Make sure to analysis research and study most of the conditions and terms at every phase of one’s video game, also consulting an economic coach when the you need to to pay off everything right up. Lots of resources of organizations such as for example Bank of America can further your understanding.

So now that you experienced the pros, you ought to learn how to buy foreclosed house without money. While it’s perhaps not a sure thing, there is discussed ten helpful tips that could result in the techniques way more attainable.

1. Merchant Resource

Known as holder capital, this strategy ‘s the habit of the vendor becoming a moneylender, sidestepping the traditional home loan processes. It fundamentally mode the bank or standard bank one is the owner of the brand new possessions often front the bucks to your purchase, delivering typical repayments right back without the necessity to have a down payment.

2. Tough Currency Loan providers

Tough currency lenders try buyers who will mortgage aside currency especially to possess small-label a property sale, making use of their appeal getting primarily into the property’s really worth in lieu of your personal finances. not, it is vital to note that difficult money lenders you are going to anticipate installment sooner than you might manage, thus make sure you get the specifics ironed out in advance of shaking any hand.

3. Rent for

A rent-to-individual offer gives you the chance to pick a home immediately after renting it to own a particular time frame. It indicates you might currently become residing in our home in advance of you purchase they, even though some deals may also tend to be a portion of the lease into the the acquisition, skipping big down costs.

cuatro. FHA Finance

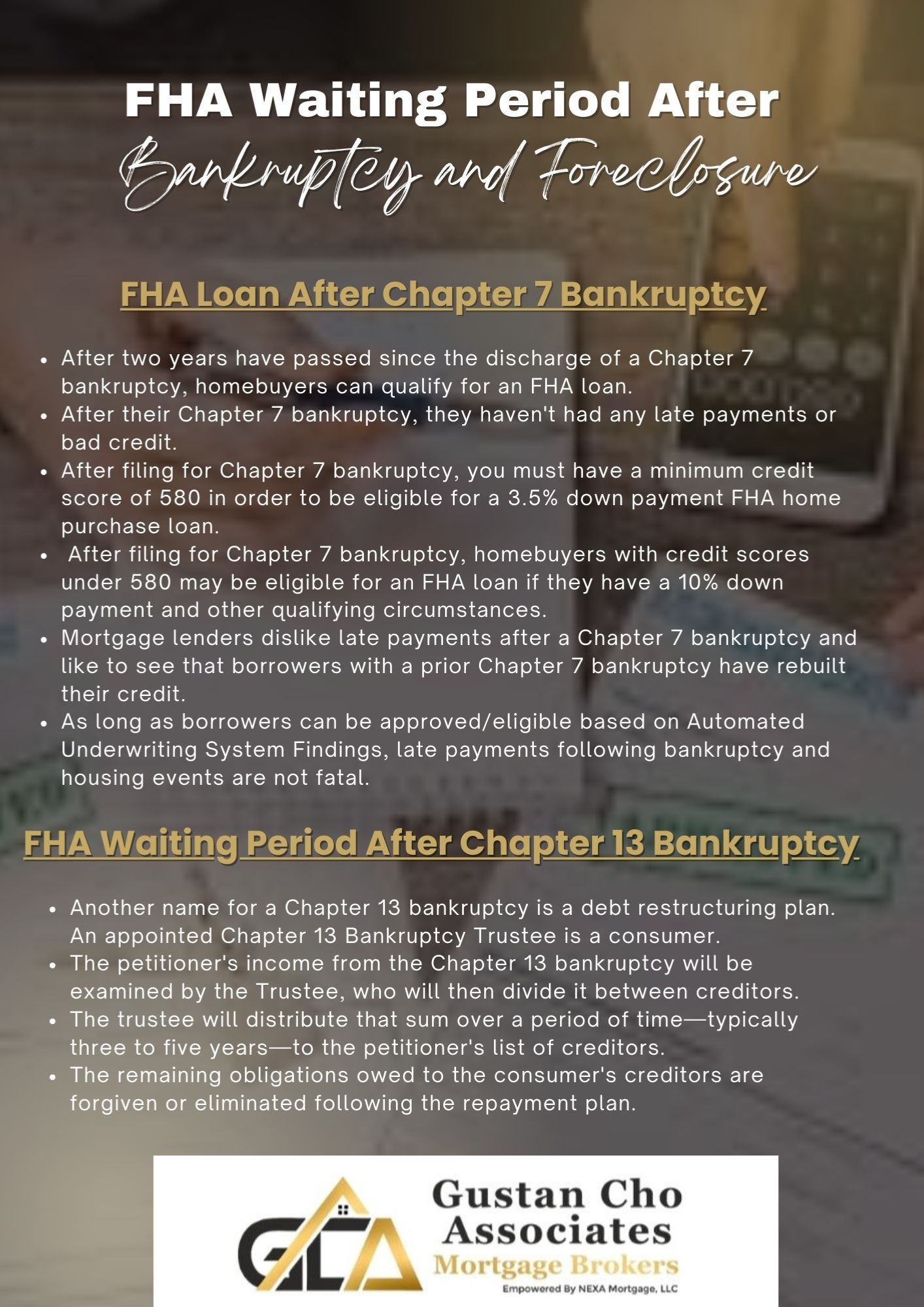

The fresh Government Casing Management (FHA) now offers loans with low down costs to have primary quarters characteristics, also certain foreclosures. The goal is to let people that have a problem with individual loan providers, and then make homeowning significantly more tangible.

5. Private Currency Loan providers

The fresh new stability out of personal money loan providers as the a technique for to acquire a foreclosure is extremely dependent up on your private problem. Knowing a friend, cherished one, otherwise personal trader that would give the money on advance payment otherwise get, you can buy come on the trying to repay versus normally pressure.

6. Virtual assistant Naugatuck loans Financing

The new Institution out-of Veterans Circumstances (VA) owns lots of foreclosed property, offering money to military experts without the need for any down payment.

eight. Household Collateral Credit line (HELOC)

For individuals who very own property already, you could potentially power property collateral credit line to finance the next buy. This is why you happen to be by using the security of the current property to begin with the procedure of purchasing yet another.

8. 203K Finance

203K Loans, known as Rehab Fund, is different FHA loans available for features in need of renovation. The borrowed funds enables you to pick and you can fix the new foreclosed domestic without advance payment, doing value for everybody parties in it.

9. USDA Rural Innovation Money

If you are looking during the an effective foreclosed assets inside an outlying city, the united states Institution out of Farming also provide a loan so you’re able to your that have zero down payment.

10. Companion Which have People

When you look at the a residential property, plenty of investors are only wanting possibilities in their freelancing. Whenever you see individuals who’s happy to top the bucks to possess a home in exchange for a percentage of the profits, you could potentially own an excellent foreclosed possessions with no private off money made.

Summary

Very, as you can tell, understanding how to get a beneficial foreclosed residence is just 1 / 2 of the fresh competition. Even in the event clear, practical tips exists, it is not a yes thing unless brand new points fall into line securely for you. Although not, when you can get there, its a great way to get your funding field otherwise lifestyle once the a resident on the right track.

No Comments