How much cash Often My personal Mortgage repayments Feel?

It is very important guarantee the house you may be to get aligns with your funds and you will financial desires. Using the homeloan payment calculator is easy and helps your influence exactly how much from a house you can economically perform. Fool around with different rates, loan terms and conditions and you may downpayment conditions to find the best combination for the finances and you can future wants.

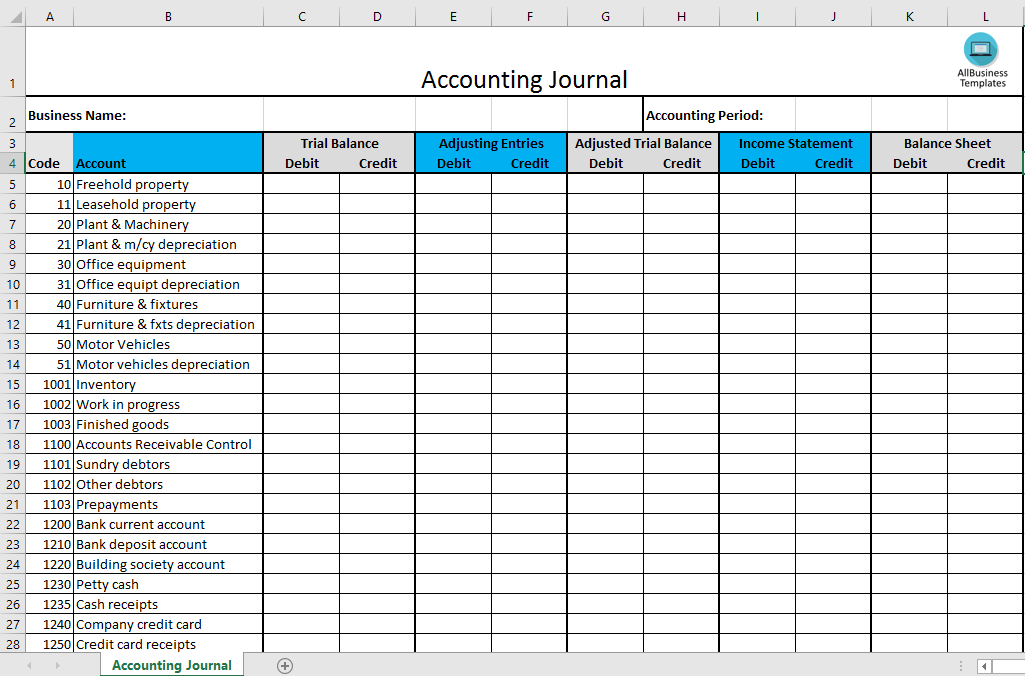

Basic Mortgage Calculator

Use the basic financial calculator to figure out your own complete monthly homeloan payment versus as a result of the annual property taxation or home insurance advanced.

- Cost. The cost you are prepared to pay money for the new house.

- Downpayment. The cash you want to deposit into the the acquisition of one’s house. The greater their down payment, the latest less loan you can wanted.

- Label. That time of your home financing, essentially mentioned in years. Home mortgage terms and conditions are typically 15 so you’re able to three decades, however, Pennymac try pleased to give bend terms. We provide regards to sixteen decades, 17 ages, 18 decades and a lot more of many funds.

- Interest. Extent energized, conveyed since the a percentage out of dominating, from the a loan provider so you’re able to a borrower into the use of currency.

Advanced Results

For more precise abilities, type in all the info regarding the basic calculator, after that change to the fresh “Advanced” case and are the after the:

- Annual assets taxation. A tax analyzed into the real estate by state government, always according to the value of the property (such as the land) you possess.

- Annual home insurance superior. Always required by lenders, home insurance covers the fresh citizen out of weather-relevant damage, along with possible accountability off situations you to definitely occur to your property.

Skills Their Home loan Calculator Performance

/GettyImages-1126388682-faaf2b46afd54db78f92b8ed7896de56.jpg)

The overall percentage is actually demonstrated on top. To get more detailed results, look at the “Malfunction,” “Over time” and “Amortization” sections.

Breakdown

- Dominant and you will appeal. Which number, expressed when you look at the bluish, includes the main, the sum of money it is possible to acquire. Including, whether your domestic costs $500,000 while borrow $350,000, your own financial could well be $350,000. That it area also contains the level of month-to-month attract you will be expenses according to research by the price and you can term of your property mortgage.

- Personal financial insurance policies (PMI). For many who input a down-payment off below 20%, you will see individual mortgage insurance provided, illustrated when you look at the red. PMI is an insurance plan one protects the financial that’s essentially you’ll need for conventional money if not place a minimum of 20% off.

- Assets fees and you will home insurance. The fee dysfunction will include your home taxes and you will homeowners insurance premiums if you decide to enter in those figures.Normally, property fees and you may homeowners insurance was factored to your monthly payment courtesy an escrow installment loans online in Texas account, therefore including those rates will give you a knowledgeable estimate away from anything you be expected to blow. Understand that assets taxation and homeowners insurance advanced can also be alter and frequently improve annually. In addition to account fully for any HOA or condominium expenses. These dues can easily create several hundred dollars or higher on homeloan payment, in addition they must be factored to your obligations-to-money proportion (DTI).

Throughout the years

Throughout the years is a look at how much cash of one’s month-to-month percentage goes towards dominant versus. notice through the years. A lot more of your fee would-be applied to your own principal because you get nearer to the end of their financial identity.

Amortization

The latest amortization section suggests their amortization schedule, a dining table record your arranged costs during your financing term. Get a month-by-few days check your percentage, kept equilibrium, dominant and notice paid off, and collective attract paid.

What’s a home loan?

Home financing was financing covered up against real property, in which the property—or home—are collateral. It is a legal agreement between a lender and the debtor. A mortgage lets a citizen to pay right back the lender inside installments more a decided-up on time period (the phrase) and you can interest rate.

How do i Rating a mortgage?

Providing a home loan needs signing up to a loan provider. However, basic, it is better to choose your finances together with matter you’ll be qualified to acquire. Take a look at Pennymac Home loan Blog having info to assist cut you currency, some time and peace of mind in the mortgage processes.

No Comments