NRI Home loans: The basics of To get Possessions in the India of Overseas

For most Low-Resident Indians (NRIs), having a bit of their homeland is an aspiration. Which have India’s housing market burgeoning, the outlook of shopping for possessions here was all the more attractive. But exactly how do that navigate this path off thousands of miles out? This web site simplifies the whole process of getting NRI lenders, an important step for the to invest in property during the Asia.

Why Asia was a stylish Marketplace for NRIs

India’s a house business keeps seen great increases, providing lucrative money ventures. Situations particularly a thriving economy, varied assets designs, and you may emotional well worth make Asia a top choice for NRIs. In addition, of numerous NRIs look at possessions within the Asia just like the a safe asset for the later years decades or due to the fact a bottom because of their parents.

Eligibility Criteria to own NRI Lenders

In advance of dive toward field, knowing the eligibility standards having lenders is a must. Basically, Indian banking companies think decades, a position standing, and you can earnings balances. NRIs normally must be utilized for a particular months for the the country of its household as well as have a stable income source.

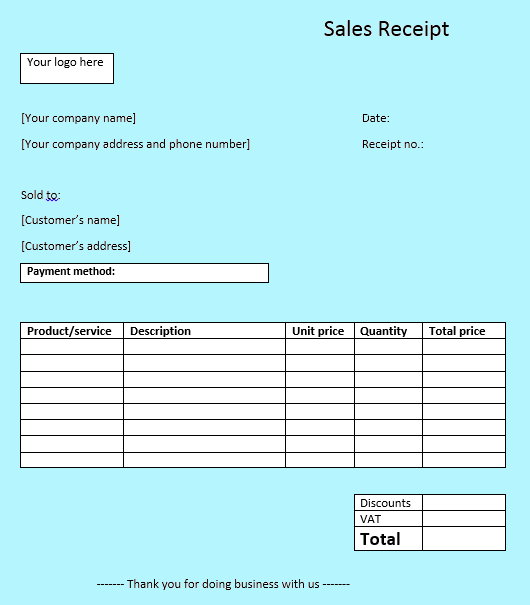

Required Papers

The newest files process to have NRIs is much more strict compared to citizen Indians. Secret data files are passport and you will visa duplicates, to another country work information, income glides, and you will NRE/NRO family savings statements. Banks also can want an electricity off attorney, helping an agent in the India to deal with purchases.

Sorts of Properties NRIs Normally Spend money on

NRIs are allowed to get most sort of assets when you look at the India except agricultural house, farmhouses, and plantation functions. Information which limit is very important to eliminate court obstacles.

Mortgage Enjoys and you may Professionals

NRI lenders include features such as for instance attractive interest rates, versatile tenure, plus the selection for a combined mortgage. The mortgage amount constantly hinges on the person’s earnings and you will property worth. Particular finance companies supply special pros for example on line account management.

Taxation Implications having NRIs

Investing in Indian a residential property is sold with the set of taxation effects. NRIs probably know of one’s taxation, money progress tax, and you will local rental tax inside the India. There are also benefits less than some sections of the funds Tax Work, which will be leveraged.

Repatriation out-of Funds

Understanding the repatriation guidelines is key. This new Reserve Lender from Asia lets NRIs so you can repatriate loans below certain standards, which should be well understood to be sure compliance and simple capital.

Deciding on the best Lender otherwise Standard bank

Selecting the right bank is just as crucial since selecting the right property. Activities such rates, financing tenure, operating charges, and customer care gamble a serious role in this choice.

The entire process of Trying to get and having a loan

The mortgage app process involves submission the application which have necessary data files, possessions verification, mortgage sanction, and finally, the loan disbursement. It is an organized procedure that need awareness of detail.

Judge Factors and Homework

Courtroom due diligence can not be overstated. NRIs would be to make certain obvious property headings, appropriate strengthening permits, and you may a reputable creator. Trying to legal counsel is often a smart action.To shop for possessions inside Asia due to the fact a keen NRI is a significant economic and you will emotional decision. Since process may appear overwhelming, understanding the subtleties out getting a loan with bad credit Wilton of NRI lenders can also be make clear it. You might want to-do thorough browse and you can demand financial and you may courtroom positives and also make so it excursion simple and satisfying. Towards the right strategy, having a dream household for the India is definitely at your fingertips to have the worldwide Indian area.

Faq’s regarding NRI Lenders

Here’s the listing of records required by a keen NRI to own a beneficial mortgage:Passport and you will charge copiesProof off residence abroadEmployment and you may earnings records particularly income slides, bank statements, and you may employment contractProperty-relevant files like the title deed, NOC, and you will contract away from saleAdditional data may be required according to bank.

Yes, NRIs can be pay back the borrowed funds inside their regional currency. The newest installment is commonly done as a consequence of Low-Resident Additional (NRE) or Low-Resident Ordinary (NRO) accounts.

The loan period varies because of the financial however, normally ranges out of 5 so you’re able to 30 years. Age the candidate and you can retirement age can also be dictate the fresh new period.

Rates to have NRI mortgage brokers are very different by lender and you will markets standards. They usually are quite more than people to own resident Indians. This new pricing will be fixed or drifting, depending on the lender’s giving.

For people who standard into the an enthusiastic NRI home loan, the results are like men and women confronted from the citizen consumers. The lender have a tendency to initially posting reminders and you can notices getting overdue money. Proceeded standard can lead to lawsuit, for instance the initiation of recovery actions beneath the SARFAESI Act. The home is caught and you will auctioned to recoup the loan count. At exactly the same time, defaulting with the that loan adversely impacts your credit rating, impacting your ability to help you safe finance in the future, both in Asia and possibly on your own nation regarding house.

The brand new limitation off an NRI financial utilizes some facts such as the borrower’s money, installment ability, and also the property’s value. Basically, finance companies inside the Asia financing around 80-85% of your own property’s worthy of for NRIs. The number can vary between finance companies and is determined founded toward NRI’s money, the type of assets getting purchased, and other eligibility requirements put because of the bank.

Yes, NRIs normally claim home financing inside the India. He or she is entitled to tax experts for the mortgage repayments comparable so you’re able to Indian residents. These experts are deductions significantly less than Part 24 to own appeal paid back towards the loan and you will below Part 80C to your dominant cost. Although not, in order to take advantage of these advantages, the brand new NRI need to file income tax productivity in the India when the its money into the India is higher than the essential exclusion limit. They have to plus adhere to the newest Foreign exchange Management Act (FEMA) laws.

No Comments