Such, you may possibly have a checking account, savings account, and/or bank card account

Monetary Glossary

- Monetary studies at your fingertips

Economic Conditions & Words Said

A-b-c D E F Grams H We J K L M Letter O P Q R S T You V W X Y Z

1099-INT mode: A taxation function you will get from the borrowing from the bank commitment otherwise almost every other financial institution you to account the fresh new payment for you of interest obtained in your coupons.

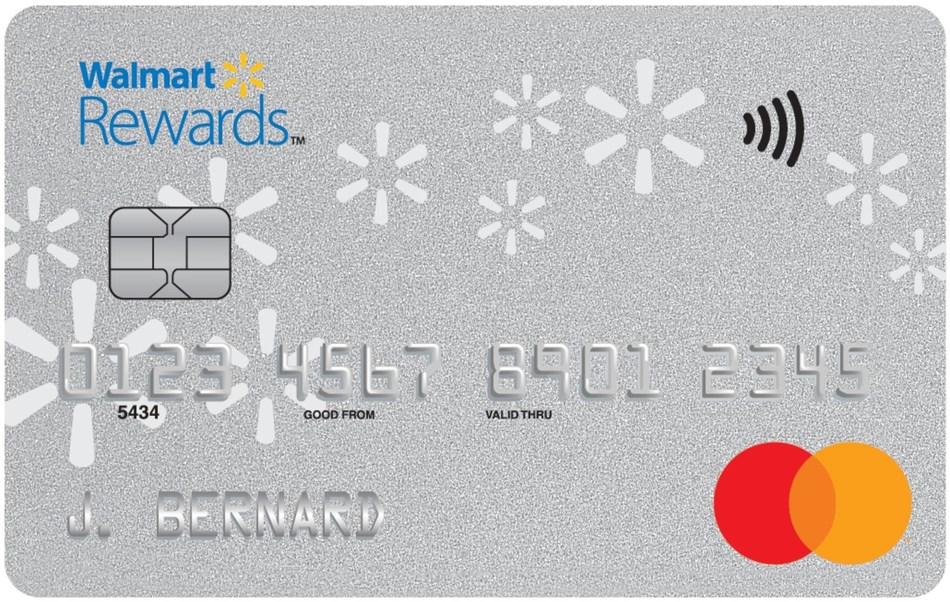

3-little finger safety code: The 3-hand (sometimes cuatro-digit) shelter password found into the a charge card lets merchants be aware that new credit member are individually holding the card as he or she decides to buy something on the internet or over the device.

401(k): A retirement savings plan funded by staff contributions and you can, have a tendency to, by partially matching efforts regarding employer. Come across as well as Roth 401(k).

Account: A corporate contract anywhere between two or more anybody or companies that boasts the new change of cash or another advantage.

Account payable: Currency that a pals owes to help you providers of products and you can characteristics purchased on borrowing from the bank. The brand new profile payable matter is a responsibility on the company. (Compare with accounts receivable.)

Membership declaration: Monitoring of deals in your credit union balance. In the event your credit union has the benefit of online banking, you generally can watch their statements on line loan places Naturita.

Membership receivable: Currency that is owed to help you a buddies to possess products or services it offers offered to people toward credit. The fresh new account receivable matter try an asset toward business. (Compare to account payable.)

Adjustable-rate financial (ARM): Home financing that have mortgage that can changes within designated menstruation, based on a published monetary index.

Advertising: Purchases texts delivered in various models eg: press, journals, billboards, emails, broadcast, tv, an internet-based. Advertisers pay money for the area you to sells the message to you personally. (The expression “ads” represents advertising.)

Affinity cards: A kind of mastercard approved as one by the a lender and you will a nonfinancial providers, such as for example a store or perhaps not-for-funds class. (Labeled as a beneficial cobranded cards whilst bears for every single partner’s name.) Because the an affinity cardholder, you usually have earned discounts and other special offers of the brand new nonfinancial companion. Oftentimes, such as for example when the nonfinancial partner is actually an ecological group, using the credit means that the team get a contribution during the their label about quantity of a percentage of purchase. Constantly an affinity cards will surely cost more to make use of than an excellent bank card directly from a card union and other financial.

American Stock-exchange: The fresh American Stock exchange (ASE) is obtained by NYSE within the 2008 and became NYCE Amex Equities in ’09. It handles throughout the 10% of all Western investments.

Annual fee give (APY): The newest productive annual speed out of come back considering the outcome out-of annual percentage rate. Its usefulness is dependant on being able to standardize different attention-rate agreements into the an annualized commission matter.

Annuity: A contract ranging from a consumer and you will an insurance coverage providers otherwise a good lender. The consumer invests currency with the insurer in exchange for a stream of money. Earnings into the financing was tax-deferred before consumer starts bringing money.

Asset: Some thing of value that a person otherwise business is the owner of. For example bucks, ties, membership receivable, index, and you can property including land, equipment for your office, or a house or car. (Compare with liability. An equivalent items will be one another an asset and you may an accountability, based on the attitude. Like, financing is actually a liability to the borrower as it signifies bad debts that might be paid down. However, on the bank, that loan was an asset because stands for currency the financial institution gets in the future since borrower repays your debt.)

No Comments