To acquire a home is like investing in their piggy bank

Chris Barry, director from the Thomas Courtroom: Annual local rental goes up and local rental demand have outstripped an upswing in the domestic prices, that has led to large designers for example Berkeley putting some choice so that aside their new products in place of sticking to the historical method out of make to offer. Towards price of borrowing decreasing and some lenders giving affairs which have miminal dumps, subscribers trying to escape of the moms and dads house should try and get in which you’ll be able to.

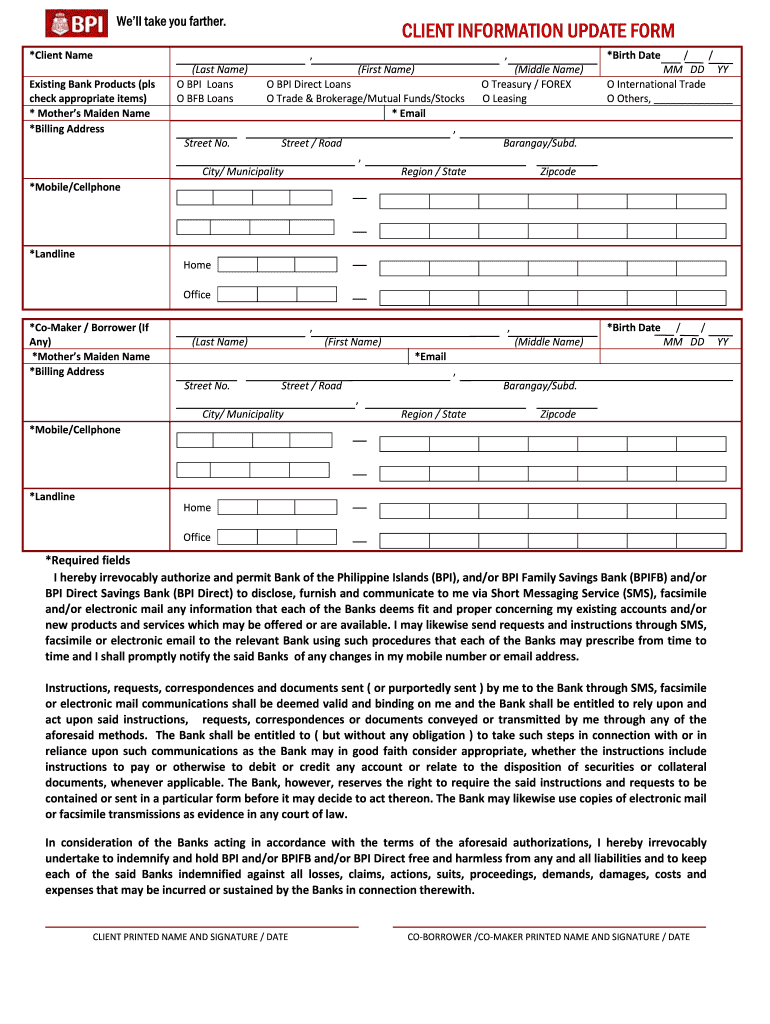

Already, for those who are experiencing collecting in initial deposit, Barclays’ Springboard and you may Skipton’s Track record mortgages could help earliest-date customers use 100% loan to really worth

Historical domestic rates constantly grown along the long run therefore though domestic pricing drop in the short term, homeowners should expect to enjoy a rise in house rates over the longer term because of a typical lack of have and you can an ever growing inhabitants. Labour’s commitment to generate step 1.5m belongings for the five years are challenging but even when it do so, it’s not going to satisfy consult. High private and you will instituational dealers was long-on belongings/a residential property into the cause over now is a great time for you to get, especially just like the value so you’re able to income proportion is leaner than simply 2007.

Simon Bridgland, director at the Discharge Liberty: The spot could make a big difference into in addition possible, but places away, buying your own home has been the least expensive solution and provides a more secure roof over your head, compared to rental assets and you will fragile local rental arrangements. For the price of renting a 2-bed house or apartment with the backyard you can purchase the same possessions however with step 3 bed rooms towards equivalent monthly cost.

That is not to state that either are thought cheap with many individuals nevertheless incapable of muster a deposit otherwise capable borrow adequate to buy a house local to where they live quicken loans Cleveland location and you can work, forcing them to both remain in hired assets, that’s scarce for almost all, otherwise remain having family members.

Gabriel McKeown, Direct from Macroeconomics at the Unfortunate Bunny Opportunities: For the majority of, the home ladder’s base rung is becoming higher than Attach Everest, with generation rent’ trapped from inside the a great spiral of soaring leasing can cost you and you will falling cost. An aggressive financial landscape therefore the prospect of next rates cuts has created a host ripe having customer interest. But really, for those caught on leasing markets, the present day affordability crisis is driving inequality between property owners and you can clients.

It’s not only cheaper long lasting, all of your current money was cutting your total financing and you may increasing your equity

The fight regarding increasing in initial deposit whenever you are using sky-higher rents keeps lead to a growing reliance on multiple highest revenues or parental direction. Since fall Finances looms, the chance out of a boost in CGT has actually remaining of a lot landlords thinking about a quick log off on the property markets. Against a background regarding a diminishing leasing likewise have, the new effects of a bulk exodus out of a third of landlords you are going to devastate the new local rental markets. If landlords flee, tenants face a perfect violent storm regarding increasing costs and you can dwindling selection, leaving the latest homeownership fantasy then unrealistic.

Darryl Dhoffer, Mortgage broker from the Mortgage Pro: Sure, leasing seems simple now, but it’s a trap. You are enriching the property manager, not oneself. The fresh new offered you own they, the greater its worthy of. Your residence worth you will definitely increase, benefiting you. Venue influences rent in place of financial. Certain parts keeps higher rents than simply home loan repayments, although some certainly are the reverse. To shop for possess initial will cost you, in the future, its particularly strengthening a nest egg yourself, rather than renting, which professionals your own property owner.

Michelle Lawson, manager during the Lawson Economic: Renting in place of purchasing try and you may many years-dated discussion. Renting try the least expensive option for somewhat an occasion, however ,more recently higher rates, alot more tension, income tax and you will regulation changes on landlords keeps created a variety enjoys left the market industry. The production strings changed. Tenants include workers and you can busineses who take corporate lets since the its cheaper than resort holiday accommodation. Buying a property confronts comparable challenges however with the risk will come certainty and you can balance your home is your very own only. The issue is usually the put. In the course of time, people purchase and you can lease for different reasons as they also have complete.

Elliott Culley, Director at Key Mortgage Financing: Really first-day consumers I handle find yourself purchasing faster four weeks to the a home loan than just these people were using toward book. Discover initial will cost you, eg solicitor will cost you, however, to purchase a property is cheaper long run on the most regarding times. it brings much time-identity shelter as you are in full control over in which you alive and the length of time.

No Comments